bank owned life insurance tier 1 capital

Bank-owned life insurance BOLI is a form of life insurance used in the banking industry. Bank Owned Life Insurance Tier 1 Capital insurance from ecosferacat fdic is tier 1 capital only when considering a boli transaction the regulators require a bank to insure that the transaction complies with its legal lending limit and concentration of credit limit.

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

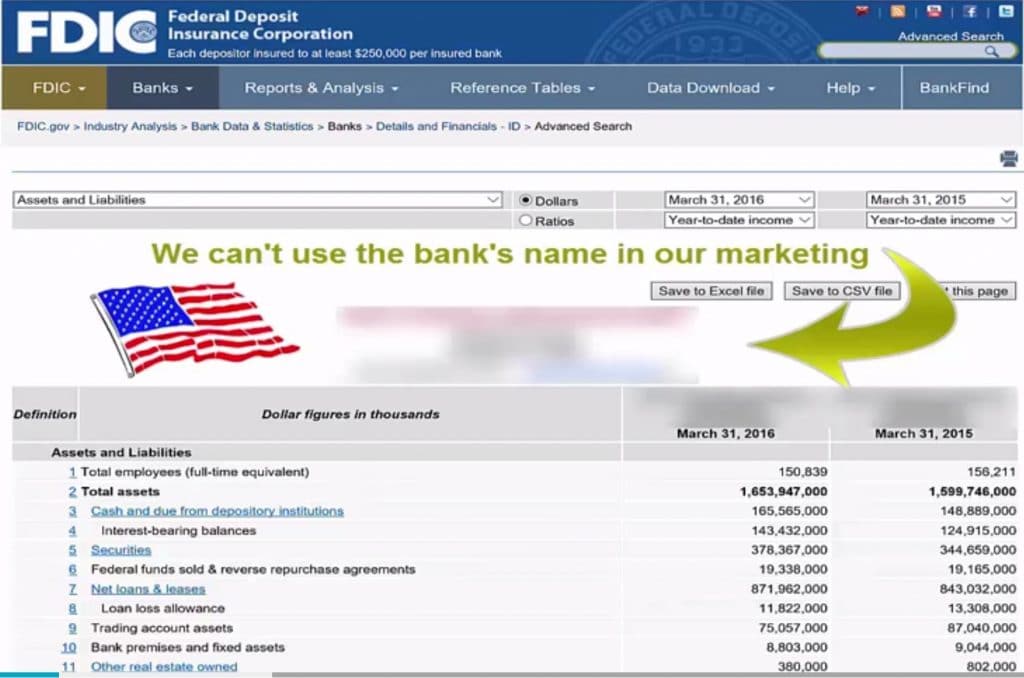

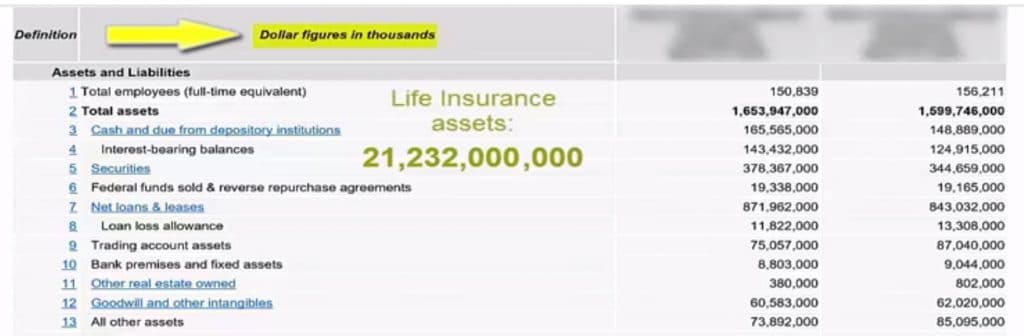

In fact banks can invest up to 25 of their Tier 1 capital in BOLI.

. Evaluate the opportunities of selling business insurance to commercial customers especially small businesses. In fact at the end of 2020 two-thirds of banks in the US. A Little Known Way Banks Make Money.

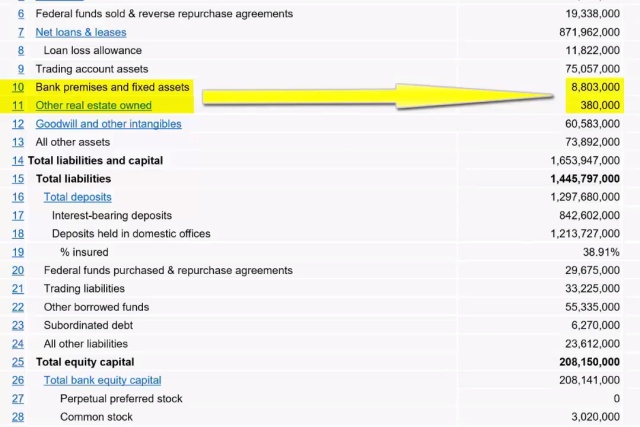

Restaurants In Erie County Lawsuit. Exceeds 25 percent of its Tier 1 capital. The most important asset in any bank is its Tier One Capital as this determines the amount of money a bank can multiply and lend out to.

Learn about the many opportunities in bank insurance. Banks may hold up to 25 of regulatory capital Tier 1 in BOLI. Are Dental Implants Tax Deductible In Ireland.

Rive Bank-Owned Life Insurance Strategies RIVEs Life Insurance Sale-Leaseback Strategy is a patented valuation strategy for banks and corporations that seek to increase their Tier 1 capital profit and valuation. Restaurants In Matthews Nc That Deliver. Banks own 100s billions of dollars in life insurance.

Bank normally uses less than 25 of Tier 1 capital to fund the bank owned life insurance policies. Trust preferred securities TruPS can now be permanently included in Tier 1 capital if certain conditions are met. Banks are the biggest buyers of high cash value life insurance because they understand the economic benefits they receive from life insurance companies.

BOLI generates non-taxable profit and loss PL earnings equal to the growth in cash surrender value. Bank-owned life insurance has been a popular way for banks to earn a tax-deferred or even tax-free return on their capital for many years. The bank sells 1 million worth of its taxable portfolio and uses the proceeds to pay for a single premium BOLI contract with cash value of 1 million upon issue.

The federal banking agencies are providing guidance on the safe and sound. How BOLI and COLI work. Banks use it as a tax shelter and to.

Assume that a bank has an average Tier I capital earnings rate of 5. The bank may hold as much as 25 percent of tier 1 capital. Review the progress banks have made selling annuities in the 1990s.

Depending on the insurance companies and an amount of the premium if 10 or more executives are selected then in most cases no medical tests require. Therefore the FDIC expects an institution that plans to acquire BOLI in an amount that. Specifically the TruPS must have been issued prior to May 19 2010 by a banking organization with less than 15 billion in assets as of December 31 2009 or the banking organization must have been in mutual form as of May 19 2010.

All banks want a strong Tier One Capital as it determines the total amount of money the bank can lend to the public which is a banks life. Find out why life insurance offers perhaps banks greatest potential for insurance sales. Majestic Life Church Service Times.

Bank Owned Life Insurance Tier 1 Capital. Treasuries since the Federal Reserve dropped rates to zero. For both benefits are either paid to the employer or directly to the employees families.

It is generally not prudent for an institution to hold BOLI with an aggregate CSV that exceeds 25 percent of its Tier 1 capital. 3 BOLI Product Types PAGE4. National banks may purchase and hold certain types of life insurance called bank-owned life insurance BOLI under 12 USC 24 Seventh.

FDIC is Tier 1 Capital only When considering a BOLI transaction the regulators require a Bank to insure that the transaction complies with its legal lending limit and concentration of credit limit. This bulletin outlined BOLI guidelines for banks and ultimately led to more financial institutions utilizing life insurance for a greater number of employees. Numerous bank insurance resources links and on.

Many banks own 15 to 25. To emphasize earnings policies are structured to maximize investment aspects and minimize expense of death benefit portion of policy. Opry Mills Breakfast Restaurants.

List life insurance as a Tier 1 Asset on their balance sheets with a combined cash value of over 182 billion. If the bank has a 40 marginal tax rate this translates to a rate of 3 on a net after-tax basis. Typically investors dont reward banks and corporations for the fair market value of their life insurance assets BOLI COLI.

It is advisable to use top 30 bank executives to avoid any potential income tax consequences. The bank may only purchase up to 15 of its Tier 1 and allowances for loan and lease losses or 1 of the banks total assets with any single insurance company because of the concentration risk. Tier 1 capital represents a banks equity and reserves.

Corporate Owned Life Insurance or COLI is life insurance on employees lives that is owned by any corporate employer not classified as a bank or credit union. In accordance with OCC 2004-56 and SR 04-19 the bank should not exceed 25 of their Tier 1 Capital plus ALL. Banks have struggled with low yields on bank-approved investments such as US.

Institutions should have a comprehensive risk management process for purchasing and holding bank-owned life insurance BOLI. Banks can purchase BOLI policies in connection with employee compensation and benefit plans key person insurance insurance to recover the cost of providing pre- and post-retirement employee benefits insurance on borrowers and. BANK-OWNED LIFE INSURANCE Interagency Statement on the Purchase and Risk Management of Life Insurance Summary.

A bank is only allowed to use up to 25 of its Tier 1 and allowances for loan and lease losses to buy BOLI.

Decoding Boli And Coli Paradigmlife Net Blog

Private Family Banking System With Whole Life Insurance Paradigm Life

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

:max_bytes(150000):strip_icc()/P2-ThomasCatalano-d5607267f385443798ae950ece178afd.jpg)

Bank Owned Life Insurance Boli

Boli Explained Paradigm Life Blog Post

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank Owned Life Insurance Boli

:max_bytes(150000):strip_icc()/retirement_piggy_bank-5bfc2fbb46e0fb0051459a09.jpg)

Bank Owned Life Insurance Boli

Boli Explained Paradigm Life Blog Post

Bank Owned Life Insurance Boli

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

How Big Banks Invest Their Safe And Liquid Reserves Banking Truths

The Biggest Life Insurance Companies In Canada 2022 Full List

Decoding Boli And Coli Paradigmlife Net Blog

Ars 1 Ars Htm 2010 Annual Report 5

Insurance Agents Guide To Bank Owned Life Insurance Redbird Agents